What is an Independent Power Producer (IPP)?

An Independent Power Producer, commonly known by the acronym IPP, is a private, non-utility business entity whose primary function is electricity generation.

Unlike traditional utilities or a public utility, an IPP does not typically own the transmission or distribution infrastructure, such as the local electricity grid or the national grid. Instead, these non-utility generators (NUGs) focus on owning and operating the generation facilities – the power plant itself – and sell their power supply to utilities, power marketers, or directly to large end users.

The Core Business Models of an IPP

The rise of Independent Power Producers has introduced new, flexible business models into the energy sector. Unlike traditional utilities that manage the entire power system from generation to billing, an IPP is a specialist.

This focus allows them to concentrate on the single most critical aspect of the power supply: the efficient operation of their generation facilities.

The Core Functionality: Generating and Selling Power

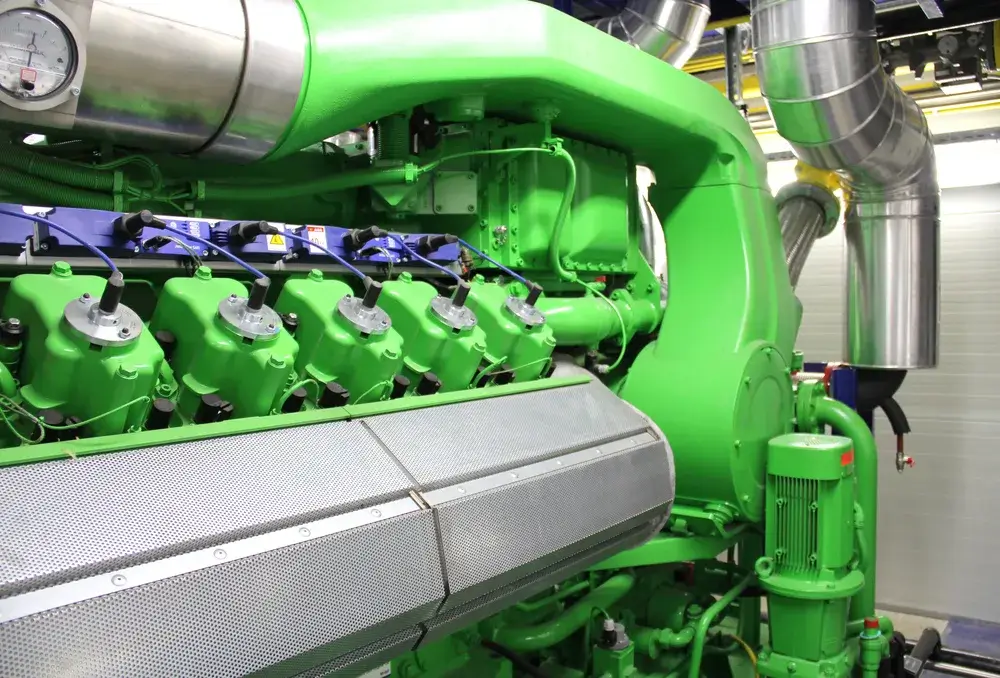

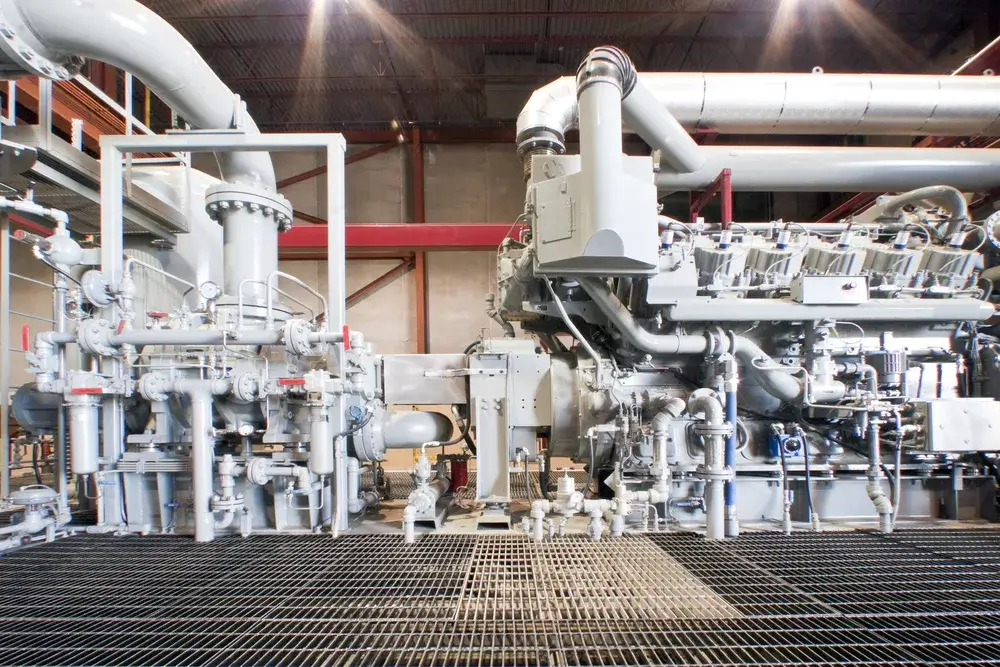

The primary functionality of an IPP is to finance, build, and operate a power plant. This asset is their core business. These generation facilities can range from a large-scale wind farm to a specialized natural gas or biogas power plant.

Their business model is not to manage the relationship with residential end users. Instead, they operate as a B2B energy generation entity, selling the electricity they produce in bulk to electric utilities, the national grid, or large industrial consumers.

The Financial Backbone: The Power Purchase Agreement (PPA)

The financial backbone for the vast majority of Independent Power Producers is the Power Purchase Agreement (PPA). This is the single most critical component of the IPP business models.

A PPA is a long-term contract, often lasting 10 to 20 years, where the IPP agrees to sell its electricity generation to a buyer at a negotiated price. This buyer is typically a public utility, one of the electric utilities, a large industrial end user, or specialized power marketers.

This guaranteed PPA revenue stream is what makes energy projects bankable, as it secures the massive upfront financing required to build the power plant.

Routes to Market: Feed-in Tariff vs. Procurement

While a PPA is the most common model, an IPP has different routes to market depending on the region’s regulations. In some energy market structures, a feed-in tariff (FiT) is used.

This is a government-mandated price that a public utility must pay the IPP for each kilowatt-hour of clean energy fed into the electricity grid. This model is often used to kick-start renewable energy energy projects.

The alternative is a competitive procurement process, where a utility or government holds an auction for a certain amount of power generation capacity, and the IPP who can provide it at the lowest cost wins the contract.

The Role of Independent Power Producers in the Energy Market

Independent Power Producers are no longer a niche part of the energy sector; they are a fundamental component of the modern power system.

Their growth has been a key factor in shaping a more competitive, decentralized, and sustainable global energy market.

Driving Competition in the Electricity Market

Historically, the electricity market in many countries was a monopoly controlled by a single public utility or a few traditional utilities. The introduction of IPPs (also known as NUGs or non-utility generators) was a deliberate policy to break these monopolies.

By allowing private generation facilities to compete, IPPs introduce pressure on pricing, drive innovation, and force the entire energy sector to become more efficient.

Accelerating the Energy Transition with Renewable Energy

IPPs are arguably the most important drivers of the global energy transition. Because they are often more agile than large traditional utilities, Independent Power Producers have been the primary investors in new renewable energy projects.

The vast majority of new wind farms, solar parks, hydro power projects, and biogas plants are built and operated by IPPs. These clean energy energy projects are essential for moving away from fossil fuels and achieving sustainability goals.

Managing Diverse Energy Sources: From Fossil Fuels to Green Energy

The IPP business models cover the full spectrum of energy sources. While many focus on green energy and renewable energy, others play a critical role in grid stability by operating highly efficient natural gas generation facilities.

These power plant assets provide a reliable power supply that can compensate for the intermittency of wind and solar. This ability to manage diverse energy systems, from fossil fuels to biomass and energy storage, makes IPPs indispensable stakeholders in meeting today’s complex energy needs.

Key Challenges for IPP Stakeholders

While the IPP model is successful, its business models are not without significant risks. As private stakeholders, Independent Power Producers bear financial and operational burdens that traditional utilities may not.

Managing Emissions and Sustainability Mandates

Independent Power Producers are on the front line of the energy transition. This means they face immense pressure to manage the emissions of their energy projects. For an IPP operating a natural gas power plant, this involves navigating complex regulations for greenhouse gas emissions and CO2.

For renewable energy IPPs, the challenge may be sourcing sustainable biomass or managing the lifecycle of their components. Meeting these sustainability mandates is a critical part of modern energy generation.

The Critical Risk: Downtime and PPA Penalties

This is the single biggest challenge for all Independent Power Producers. Their revenue is directly tied to the Power Purchase Agreement (PPA). This contract is a promise to deliver a specific amount of power generation.

If the IPP’s generation facilities – such as a biogas or natural gas engine – fail, they cannot produce electricity. This results in an immediate loss of revenue and, in many PPA contracts, severe financial penalties for failing to deliver the promised power supply to the public utility or electricity grid.

How PowerUP Secures Your IPP Profitability

The success of an Independent Power Producer is not just about having a good PPA, it is about the operational reliability of the power plant. Every hour of downtime is a direct threat to the profitability of your energy projects.

PowerUP is the ideal partner for IPP stakeholders who rely on Jenbacher or MWM energy systems. We understand that your gas engine is the heart of your revenue. Technology is our drive, efficiency our focus.

We provide the specialized, high-durability spare parts, engine upgrades, and expert field service that Independent Power Producers need to eliminate unplanned downtime. We help you secure your power supply, meet your PPA obligations, and maximize the profitability of your generation facilities.